Bull trend confirmed: Nasdaq tags first technical target (15,370)

Focus: Semiconductors challenge record highs, Japan's trendline breakout, SMH, EWJ, SNOW, HOV, AMKR, UPST

Technically speaking, the major U.S. benchmarks are starting September amid a still firmly-entrenched bull trend.

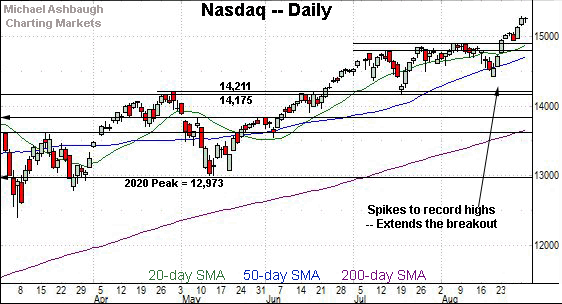

On a headline basis, the Nasdaq Composite has staged an unusual two standard deviation breakout, rising to effectively tag its first technical target (15,370).

The week-to-date peak (15,367) has registered nearby.

Editor’s Note: As always, updates can be directly accessed at chartingmarkets.substack.com.

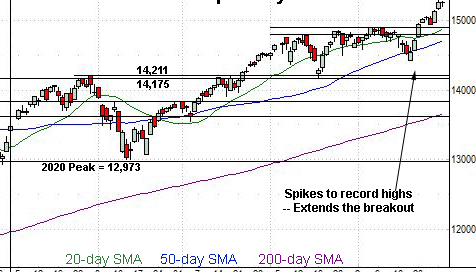

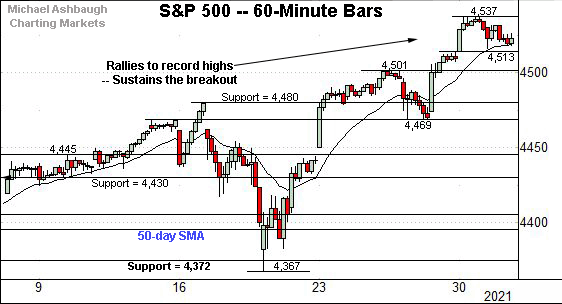

Before detailing the U.S. markets’ wider view, the S&P 500’s hourly chart highlights the past four weeks.

As illustrated, the S&P continues to trend higher.

Tactically, near-term floors — around 4,513 and the 4,500 mark — are followed by the former breakout point (4,480).

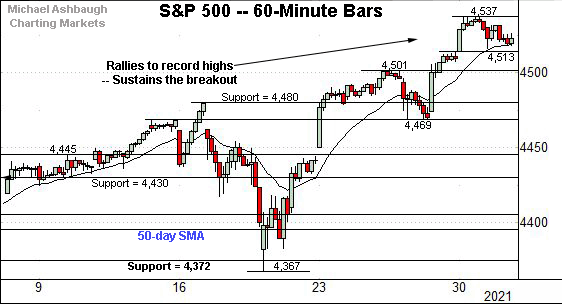

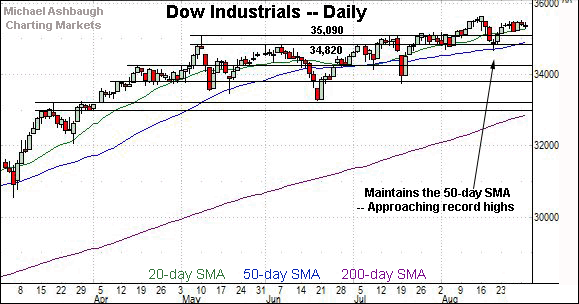

Meanwhile, the Dow Jones Industrial Average has not broken out.

The index remains capped by near-term resistance (35,510), detailed repeatedly.

In fact, the week-to-date peak (35,510) has precisely matched resistance.

Conversely, the week-to-date low (35,289) has closely matched familiar near-term support (35,285).

As always, technical price action is bullish amid a strong uptrend.

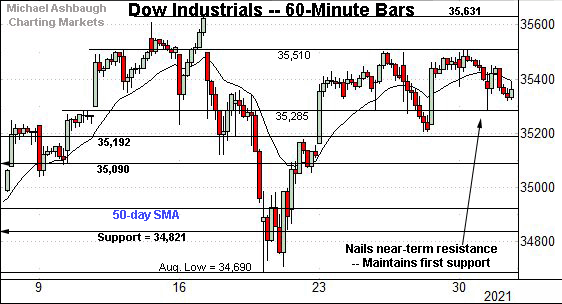

Against this backdrop, the Nasdaq Composite remains the strongest major benchmark.

The index has registered directionally sharp breaks to record territory — (see the arrows) — punctuated by comparably flat pullbacks. Bullish momentum is intact.

Tactically, gap support (15,144) is followed by the former range top (15,059).

Widening the view to six months adds perspective.

On this wider view, the Nasdaq continues to take flight, placing distance atop the 15,000 mark.

In the process, the index has effectively reached its near-term target of 15,370, detailed repeatedly. (See for instance, the Aug. 23 review, and subsequent reviews.)

Wednesday’s early session high (15,367) has closely matched the target.

On further strength, a slightly more distant target continues to project from the July range to the 15,420 area.

Looking elsewhere, the Dow Jones Industrial Average has not yet reached record territory.

Nonetheless, the index has sustained its bullish reversal from the 50-day moving average. Constructive price action.

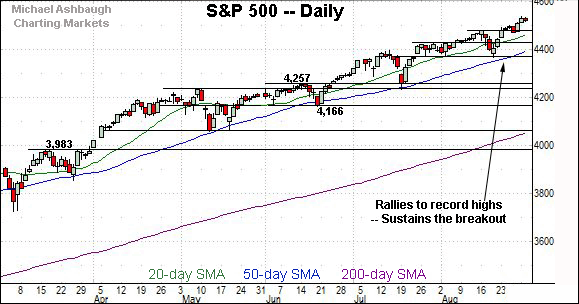

Meanwhile, the S&P 500 has extended its latest break to record territory.

Recent follow-through punctuates bullish reversal from major support (4,372).

The bigger picture

As detailed above, the major U.S. benchmarks are acting well technically.

On a headline basis, the Nasdaq Composite has staged a 2.5% technical breakout, confirming its primary uptrend. Moreover, the prevailing upturn an unusual two standard deviation breakout, encompassing consecutive closes atop the 20-day Bollinger bands.

Meanwhile, the S&P 500 has rallied less aggressively, though its prevailing 1.1% breakout is also sufficient to confirm the primary uptrend.

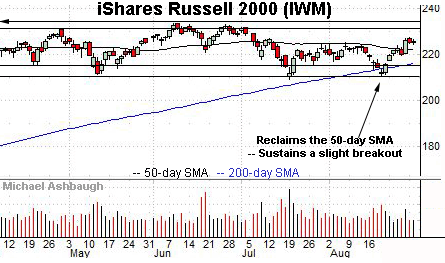

Moving to the small-caps, the iShares Russell 2000 ETF is showing signs of life technically.

The small-cap benchmark has sustained its strong-volume rally atop the 50-day moving average, currently 222.32, consolidating amid decreased volume. Constructive price action.

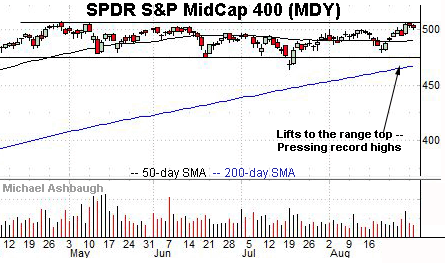

Looking elsewhere, the SPDR S&P MidCap 400 ETF continues to press record territory.

Though last week’s close (504.96) marked a nominal record close, the MDY’s absolute record peak (507.63), established April 29, remains slightly more distant.

Still, the prevailing flattish pullback — amid decreased volume — signals muted selling pressure near resistance, improving the chances of an eventual breakout.

The MDY is rising from a prolonged range, laying the groundwork for potentially material upside follow-through.

Placing a finer point on the S&P 500, the index is digesting its latest break to record territory.

To reiterate, near-term support points — around 4,513 and 4,500 — are followed by the former breakout point (4,480).

Delving much deeper, the prevailing upturn originates from the one-month range bottom (4,372), an area also illustrated below.

More broadly, the S&P 500 continues to trend steadily higher. Recall the relatively steep slope of the 200-day moving average tracks a trajectory similar to that of the 50-day moving average.

Also recall the sharp August reversal from one-month lows resembles the aggressive mid-July rally from one-month lows. Both rallies originated from major support — the 4,257 and 4,372 areas.

Based on today’s backdrop, the breakout point (4,480) is followed by the S&P’s former range top (4,430).

Delving deeper, the 50-day moving average, currently 4,396, is followed by major support (4,372) closely matching the August low.

Tactically, an eventual violation of this area would mark a material “lower low” — combined with a violation of the 50-day moving average — raising a technical question mark.

The S&P 500’s intermediate-term bias remains comfortably bullish barring a violation of the 4,370 area.

Editor’s Note: The next review will be published next Wednesday. The U.S. markets are closed Monday, Sept. 4 for Labor Day.

Watch List

Drilling down further, the VanEck Vectors Semiconductor ETF is acting well technically.

As illustrated, the group has sustained a slight break to record highs, edging atop the early-August peak.

The prevailing upturn punctuates a successful test of trendline support.

Tactically, a near-term target projects to the 290 area. Conversely, the breakout point (271.20) is followed by the former range top (266.00).

Looking elsewhere, the iShares MSCI Japan ETF has come to life technically.

As illustrated, the shares have rallied atop trendline resistance, an area closely matching the 100- and 200-day moving averages. The breakout raises the flag to a trend shift.

Tactically, the 200-day moving average, currently 68.10, closely matches gap support (68.13). The prevailing recovery attempt is intact barring a violation.

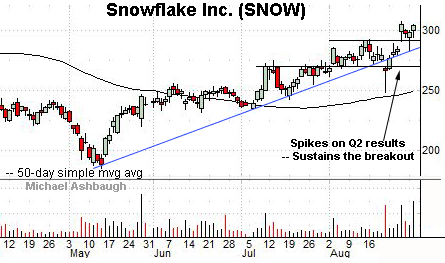

Initially profiled Aug. 13, Snowflake, Inc. remains well positioned.

Late last month, the shares knifed to record highs, rising after the company’s strong second-quarter results. The subsequent flag-like pattern positions the shares to build on the strong-volume spike.

Tactically, trendline support is rising toward the breakout point (291.50). A posture higher signals a firmly-bullish bias.

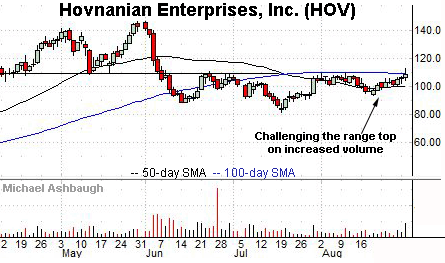

Hovnanian Enterprises, Inc. is a small-cap homebuilder showing signs of life.

As illustrated, the shares are challenging a nearly three-month range top closely matching the 100-day moving average, currently 109.20.

The prevailing upturn punctuates a head-and-shoulders bottom defined by the June, July and August lows. An intermediate-term target projects to the 124 area.

Conversely, the 50-day moving average, currently 100.10, effectively underpinned the August price action. A breakout attempt is in play barring a violation.

Note the company’s quarterly results are due out Sept. 9.

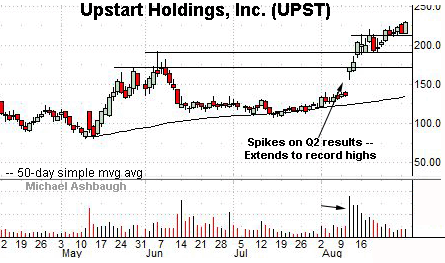

Public since December 2020, Upstart Holdings, Inc. is a large-cap developer of AI-based lending solutions. (AI = Artificial Intelligence.)

The shares initially spiked three weeks ago, gapping to record territory after the company’s strong quarterly results.

More immediately, the shares have formed consecutive flag-like patterns, building on the initial strong-volume spike.

Tactically, a sustained posture atop near-term support — the 211.25-to-212.20 area — signals a comfortably bullish bias.

Finally, Amkor Technology, Inc. is a well positioned large-cap semiconductor name.

As illustrated, the shares have knifed to the range top, tagging a nominal 20-year high.

The prevailing upturn originates from the breakout point, circa 24.00, an area closely matching the 50-day moving average. A near- to intermediate-term target projects to the 31 area on follow-through.

Editor’s Note: The next review will be published next Wednesday. The U.S. markets are closed Monday, Sept. 4 for Labor Day.