Charting a bullish technical tilt, S&P 500 tags latest record high

Focus: Financials clear major resistance, 10-year yield challenges 200-day average, XLF, SQ, QRVO, DOCU, CLF

U.S. stocks are mixed mid-day Friday, vacillating after a stronger-than-expected monthly jobs report.

Against this backdrop, the S&P 500 has tagged its latest record high, and is vying to register a more decisive break to uncharted territory. The prevailing upturn originates from near-term support (4,372).

Editor’s Note: As always, updates can be directly accessed at chartingmarkets.substack.com.

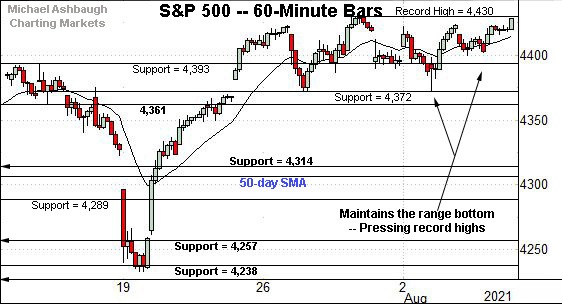

Before detailing the U.S. markets’ wider view, the S&P 500’s hourly chart highlights the past four weeks.

As illustrated, the S&P has rallied to its range top, rising to register its latest record close (4,429.10). Friday’s early upturn punctuates slightly more decisive follow-through.

More broadly, the prevailing upturn punctuates a flag-like pattern hinged to the steep mid-July rally.

Recall the August low (4,373) has closely matched support (4,272). Bullish price action.

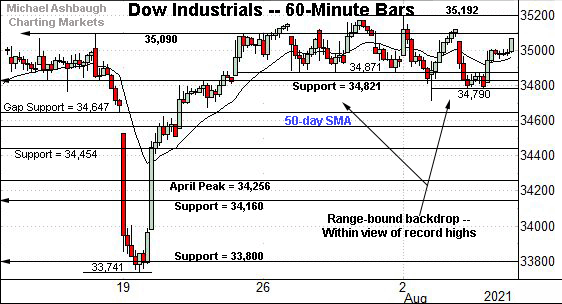

Similarly, the Dow Jones Industrial Average has asserted a relatively orderly range, digesting the steep mid-July rally.

Within the range, the prevailing upturn places record highs within view. An extended breakout attempt remains underway.

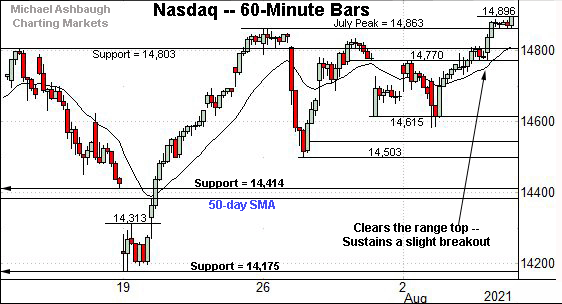

Against this backdrop, the Nasdaq Composite has tagged its latest record high.

Tactically, the breakout point (14,863) is followed by the former range top (14,803) and slightly deeper near-term support (14,770).

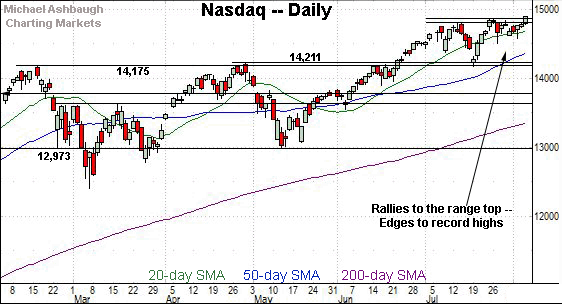

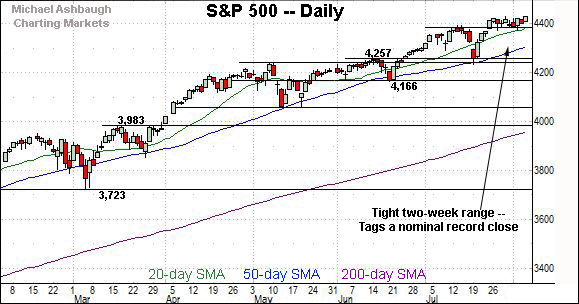

Widening the view to six months adds perspective.

On this wider view, the Nasdaq is challenging its range top.

Though Thursday’s close marked a nominal record, the index has pulled in to its range early Friday, pressured amid surging Treasury yields after the stronger-than-expected monthly jobs report.

Still, a jagged breakout attempt remains underway.

More broadly, the prevailing upturn originates from a successful test of the breakout point (14,175).

On further strength, a near- to intermediate-term target continues to project to the 15,420 area, detailed previously.

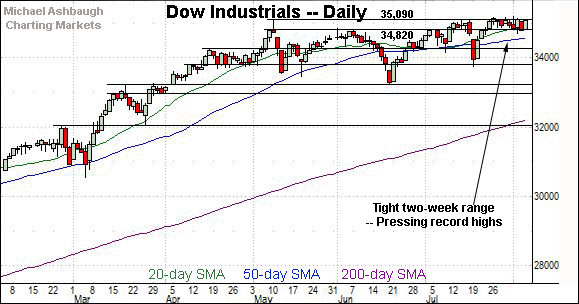

Looking elsewhere, the Dow Jones Industrial Average continues to challenge record territory.

Tactically, the prevailing tight two-week range — a coiled spring — lays the groundwork for potentially decisive upside follow-through.

More broadly, the Dow is rising from a modified head-and-shoulders bottom, defined by the May, June and July lows.

Collectively, the prevailing six-month backdrop remains comfortably bullish.

Meanwhile, the S&P 500 has asserted a flag-like pattern digesting the steep mid-July rally.

The tight range has been punctuated by modest follow-through to conclude this week. The “expected” breakout attempt is underway.

The bigger picture

As detailed above, the major U.S. benchmarks are acting well technically.

On a headline basis, each big three U.S. benchmark has registered its latest record this week.

Against this backdrop, potentially consequential breakout attempts remain underway, amid still bullish sector rotation, detailed repeatedly.

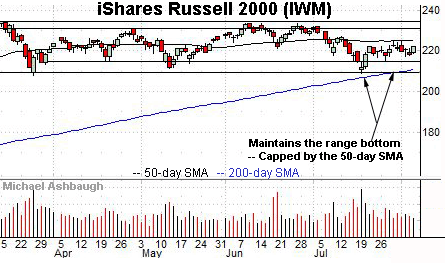

Moving to the small-caps, the iShares Russell 2000 ETF remains range-bound.

Within the range, the flatlining 50-day moving average, currently 225.01, signals trendless price action.

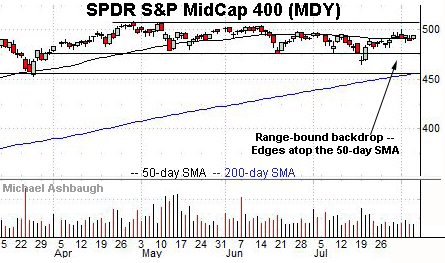

Meanwhile, the SPDR S&P MidCap 400 ETF is effectively hugging its 50-day moving average, currently 490.80.

Placing a finer point on the S&P 500, the index has registered its latest record close.

Tactically, the prevailing upturn punctuates a successful test of the range bottom (4,272).

The August low (4,273) has registered nearby.

More broadly, the S&P 500 is rising from a flag-like pattern, effectively underpinned by the breakout point (4,393).

Slightly more broadly, the bullish continuation pattern is hinged to the steep mid-July rally, underpinned by major support (4,257).

On further strength, upside targets continue to project from the July range to the 4,510 and 4,553 areas.

Beyond specific levels, the bigger-picture backdrop has strengthened to start August amid broadening sector participation, detailed last week. The financials’ prevailing breakout attempt — detailed in the next section — exemplifies the rotational backdrop.

Watch List

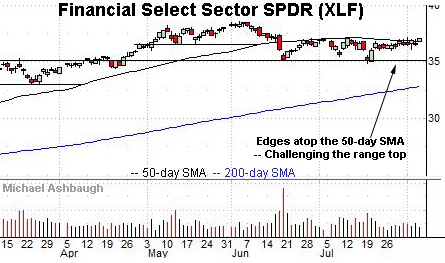

Drilling down further, the Financial Select Sector SPDR — profiled last week — is showing signs of life technically. (Yield = 1.6%.)

As illustrated, the group has edged atop the 50-day moving average, currently 36.84, rising to challenge the range top (37.14), detailed previously.

Thursday’s close (37.11) effectively matched the range top, and the group has followed through higher early Friday, rising amid surging Treasury yields after the stronger-than-expected monthly U.S. jobs report. (The benchmark 10-year Treasury note yield is challenging its 200-day moving average, currently 1.297, early Friday.)

The prevailing upturn punctuates an unusually tight two-week range, laying the groundwork for potentially decisive follow-through. On further strength, a near-term target projects to the 39.40 area.

Conversely, the 50-day moving average pivots to support, and is followed by the prevailing range bottom (36.00).

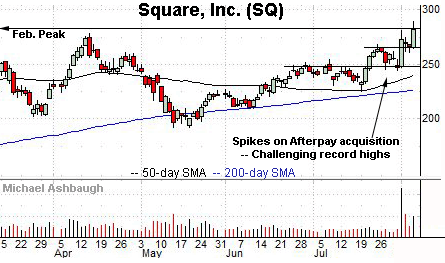

Square, Inc. is a large-cap developer of digital-payment solutions.

The shares started August with a strong-volume spike, rising after the company reported its second-quarter results, and announced the acquisition of Australia-based Afterpay — a buy-now, pay-later (BNPL) specialist — for about $29 billion in stock.

The upturn places Square’s all-time high under siege, a level formerly defined by the February peak (283.19).

Tactically, a breakout attempt is in play barring a violation of near-term support, circa 266.40.

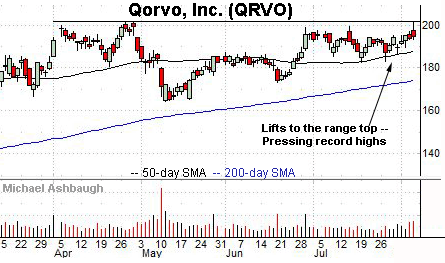

Qorvo, Inc. is a well positioned large-cap semiconductor name.

As illustrated, the shares have rallied to the range top, rising after the company’s better-than-expected quarterly results, released after Wednesday’s close.

The prevailing upturn punctuates a head-and-shoulders bottom, defined by the April, May and July lows. Within the pattern, the 50-day moving average has marked an inflection point.

Tactically, near-term support (194.00) is followed by the 50-day moving average, currently 187.85. A sustained posture higher signals a bullish bias.

DocuSign, Inc. is a large-cap e-signature solutions provider.

Technically, the shares have asserted a flag-like pattern, digesting the mid-July break to record territory.

As always, the flag is a bullish continuation pattern, in this case hinged to the initially steep June rally.

Tactically, the prevailing rally attempt is intact barring a violation of the breakout point, circa 290.20, and the August low (288.37).

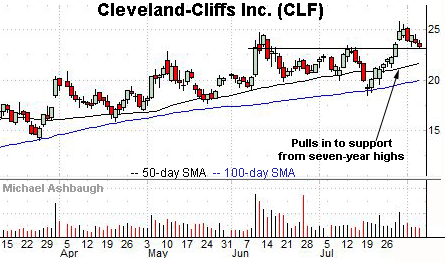

Finally, Cleveland-Cliffs, Inc. is a well positioned large-cap steel producer.

Late last month, the shares knifed to seven-year highs, rising after the company disclosed it has bought back from ArcelorMittal (MT) all of its Series B Redeemable Preferred Stock, a move that reduces the share count, and signals management confidence in the company’s outlook.

The subsequent pullback places the shares near the breakout point (23.10) and 10.8% under the July peak.