Charting a corrective bounce, S&P 500 (barely) maintains major support

Focus: Nasdaq capped by breakdown point, Dow industrials survive initial test of 200-day average

U.S. stocks are higher mid-day Monday, rising in the wake of an aggressive market downdraft.

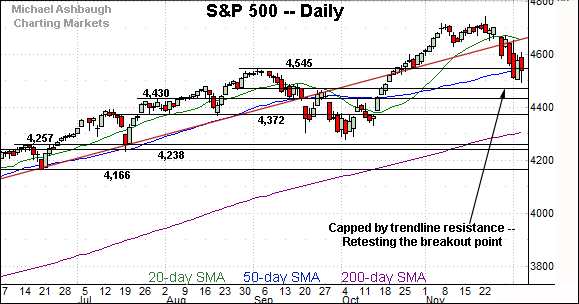

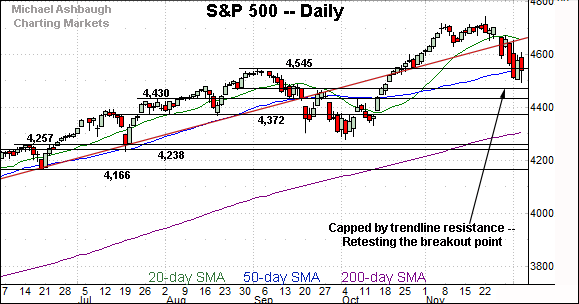

Against this backdrop, the S&P 500 has thus far weathered a jagged test of major support — S&P 4,545 — a familiar bull-bear fulcrum closely matching the 50-day moving average.

Editor’s Note: As always, updates can be directly accessed at chartingmarkets.substack.com.

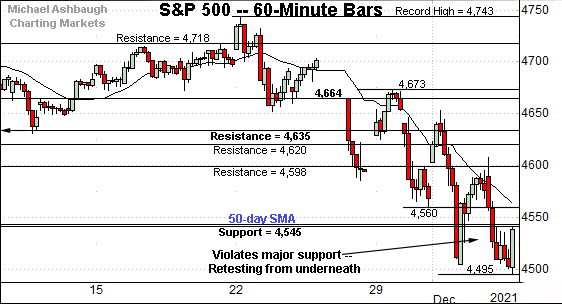

Before detailing the U.S. markets’ wider view, the S&P 500’s hourly chart highlights the past four weeks.

As illustrated, the S&P has reached an important technical test.

Specifically, the index is retesting its breakout point (4,545) a level matching the 50-day moving average, currently 4,547.

Last week’s close (4,538) registered slightly under support, though the S&P is firmly higher early Monday.

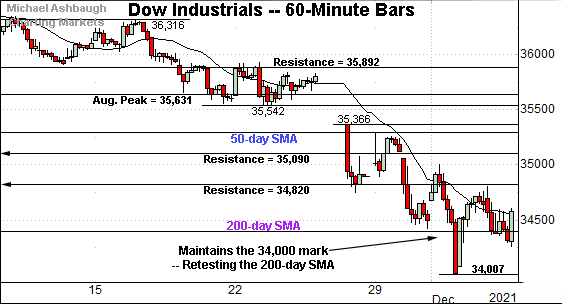

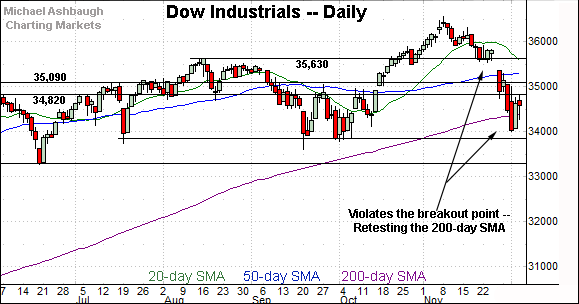

Meanwhile, the Dow Jones Industrial Average seems to have weathered a headline technical test.

As illustrated, the index whipsawed at its 200-day moving average, currently 34,410, reversing to close last week atop the trending indicator.

Tactically, initial resistance (34,820) is followed by the May peak (35,091) and the more distant 50-day moving average, currently 35,296.

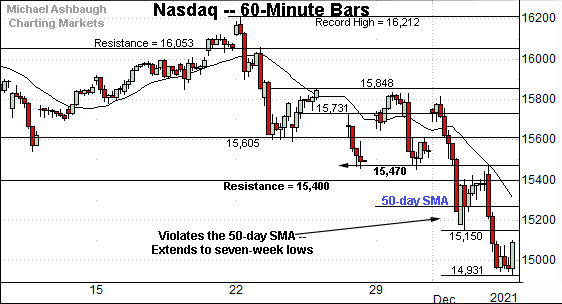

Against this backdrop, the Nasdaq Composite is off to an equally shaky December start.

In its case, the index has violated its breakout point — circa 15,400 — and observed this area as resistance.

The subsequent downside follow-through places it under the 50-day moving average, currently 15,277.

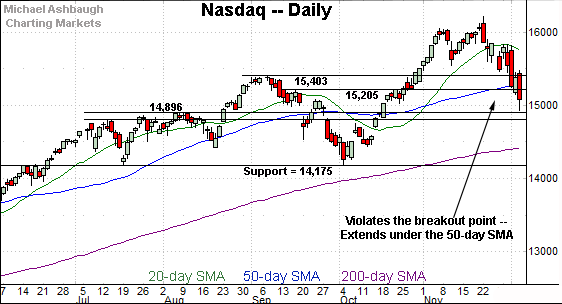

Widening the view to six months adds perspective.

On this wider view, the Nasdaq has extended its downdraft from record highs.

The prevailing pullback places the index under its breakout point (15,403), a level marking its first significant support.

To reiterate, the relatively swift violation of support — on the first approach — suggests this is not a garden-variety pullback.

Delving deeper, the 50-day moving average, currently 15,277, is followed by the former range top (15,205). Tactically, a sustained posture under this area signals a bearish-leaning intermediate-term bias.

Looking elsewhere, the Dow Jones Industrial Average has whipsawed at its 200-day moving average, currently 34,410.

As always, the 200-day moving average is a widely-tracked longer-term trending indicator. The index has thus far weathered a jagged retest, punctuated by a lone close under the 200-day.

Nonetheless, the Dow’s intermediate-term bias remains bearish based on today’s backdrop.

Tactically, the former range top (34,820) is followed by an inflection point matching the May peak (35,091) and the 50-day moving average, currently 35,296. Sustained follow-through atop these areas would place the Dow on firmer technical ground.

Meanwhile, the S&P 500 has also staged a jagged technical test.

Specifically, the index has challenged its breakout point (4,545) a level closely matching the 50-day moving average, currently 4,547.

Recall the prevailing downturn punctuates a failed test of trendline resistance.

The bigger picture

As detailed above, the major U.S. benchmarks continue to whipsaw amid shaky December price action.

Against this backdrop, the S&P 500 has thus far narrowly maintained major support — S&P 4,545 — a level currently matching the 50-day moving average.

Elsewhere, the Nasdaq Composite and Dow industrials have ventured firmly under their corresponding breakout points — the Nasdaq 15,400 and Dow 35,630 areas. (Both benchmarks have also violated their 50-day moving average.)

Amid the volatility, potential consequential technical tests remain in play.

Moving to the small-caps, the iShares Russell 2000 ETF has violated its 200-day moving average, currently 224.38, pressured amid a sustained volume spike.

Also recall the failed initial retest of the 200-day from underneath. Bearish price action.

On further weakness, the prevailing range bottom — the 209.05-to-210.70 area — marks an important floor. An eventual violation would mark a material “lower low” opening the path to potentially swift downside follow-through.

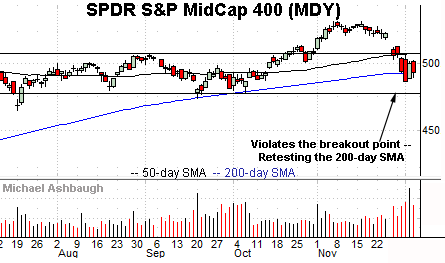

Meanwhile, the SPDR S&P MidCap 400 ETF continues to challenge its 200-day moving average, currently 493.00.

Here again, the downturn has been punctuated by increased volume.

Tactically, a reversal atop the former breakout point, circa 506.00, would place the MDY on firmer technical ground.

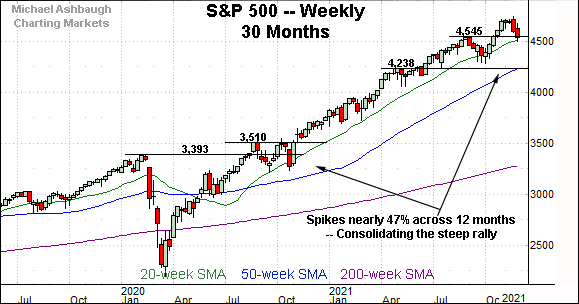

Returning to the S&P 500, the chart above is a weekly view spanning 30 months. Each bar on the chart represents one week.

To reiterate, the index is consolidating a massive 12-month, 46.6% rally from the November 2020 low — (just before the U.S. election) — to the November 2021 peak.

Across this span, the S&P has registered just one weekly close slightly under its 20-week moving average, currently 4,516. (The late-September weekly close registered three points under the 20-week moving average.)

Moving to the S&P 500’s six-month view, the index has pulled in aggressively from recent record highs.

Notably, the downturn has been punctuated by two nearly 9-to-1 down days across a narrow three-session window. (Declining volume has surpassed advancing volume by a 9-to-1 margin.)

As always, in a textbook world, two 9-to-1 down days — across about a seven-session window — would reliably signal a material trend shift. (See Friday’s review for added detail regarding the internals, including an asterisk applied to the day-after-Thanksgiving downdraft.)

Against this backdrop, the U.S. benchmarks have registered bearish December price action in key spots.

For instance, the Nasdaq Composite and Russell 2000 have violated major support on the first approach, and subsequently failed retests from underneath. (See Nasdaq 15,400 and the Russell 2000’s 200-day moving average.)

Amid bearish price action elsewhere, the S&P 500’s prevailing backdrop remains straightforward.

Specifically, an extended retest of the breakout point (4,545) — a familiar bull-bear fulcrum, detailed repeatedly — remains underway.

As always, it’s not just what the markets do, it’s how they do it.

But broadly speaking, a sustained violation of the 4,545 area would signal an intermediate-term trend shift. The quality of the prevailing rally from this area will likely add color.