Charting a slow-motion breakout attempt, S&P 500 tags nominal record high

Focus: Financials grind to record highs, Gold signals April trend shift, XLF, GLD, AXP, SHOP, CVX

This is the second edition of Charting Markets by Michael Ashbaugh, formerly the founder and editor of The Technical Indicator.

Updates can be accessed at chartingmarkets.substack.com. Your smartphone can also access updates at the same address, chartingmarkets.substack.com.

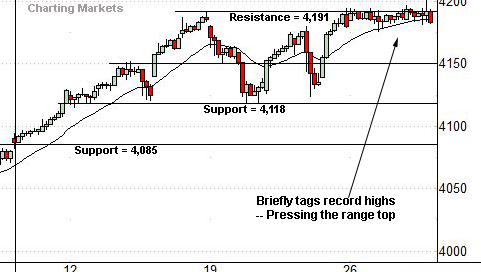

Before detailing the U.S. markets’ wider view, the S&P 500’s hourly chart highlights the past four weeks.

As illustrated, the S&P continues to challenge record territory.

The index briefly tagged a record high (4,201) Wednesday — after the Federal Reserve’s policy statement — but is hugging its range top in the broad sweep. An extended breakout attempt remains underway early Thursday.

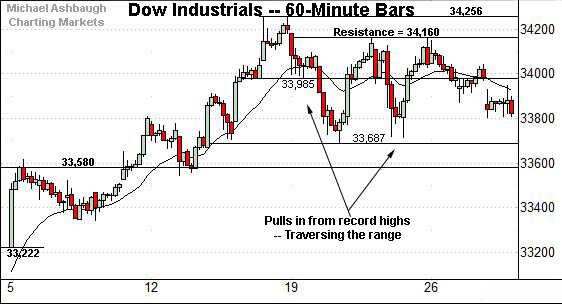

Meanwhile, the Dow Jones Industrial Average remains range-bound, extending a modest week-to-date downturn.

Tactically, recall the range top (34,160) is followed by the Dow’s record close (34,200) and absolute record peak (34,256).

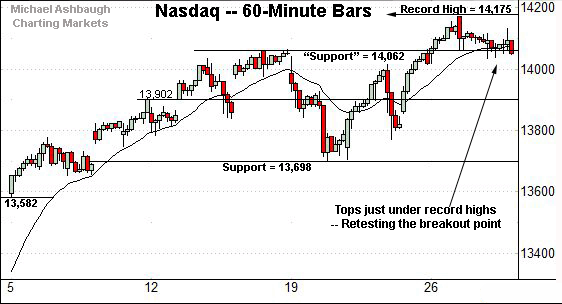

Against this backdrop, the Nasdaq Composite is digesting a late-April breakout, of sorts.

Tactically, a near-term floor matches the breakout point (14,062), detailed previously.

Thursday’s early session low (14,064) registered nearby.

Separately, the index continues to challenge record highs, a backdrop better illustrated on the daily chart below.

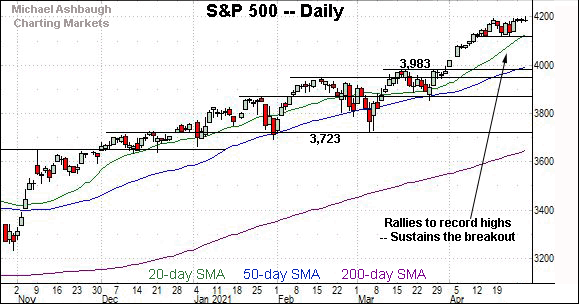

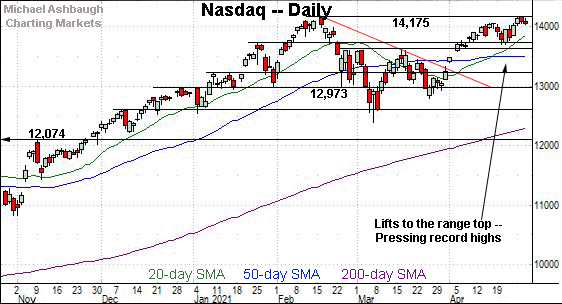

Widening the view to six months adds perspective.

On this wider view, the Nasdaq is pressing its range top, an area defining record territory.

In fact, Thursday’s early session high (14,211) marked a new record, though the index has pulled back in to its range.

Tactically, the prevailing range bottom, circa 13,700, is followed by the March peak (13,620) and the flatlining 50-day moving average, currently 13,509. A sustained posture atop this area signals a bullish intermediate-term bias.

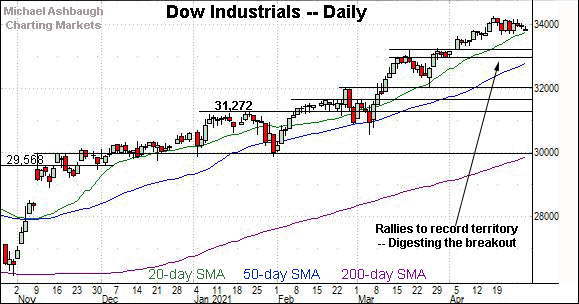

Looking elsewhere, the Dow Jones Industrial Average remains in consolidation mode.

Recall the late-April bull flag — the tight two-week range — is a bullish continuation pattern.

Tactically, the range bottom (33,687) is followed by a deeper floor, circa 33,580, areas better illustrated on the hourly chart.

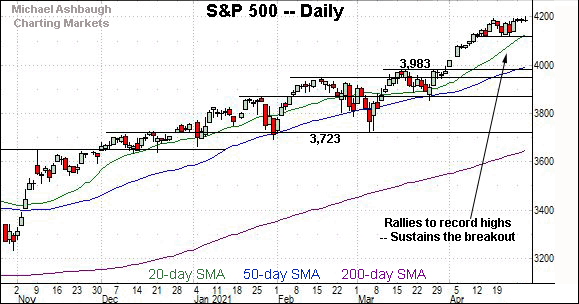

Meanwhile, the S&P 500 continues to challenge record territory.

Consider that the index has registered nominal record highs Monday, Wednesday and early Thursday. A slow-motion breakout attempt remains underway, also detailed on the hourly chart.

The bigger picture

U.S. stocks are mixed early Thursday — and well off the early session highs — vacillating after strong first-quarter GDP data, and a largely better-than-expected batch of influential quarterly earnings reports.

Against this backdrop, the bigger-picture technicals remain constructive.

Moving to the small-caps, the iShares Russell 2000 ETF continues to press its range top, an area matching the Feb. peak (230.30).

Recall that follow-through atop resistance likely opens the path to a retest of the record high (234.53).

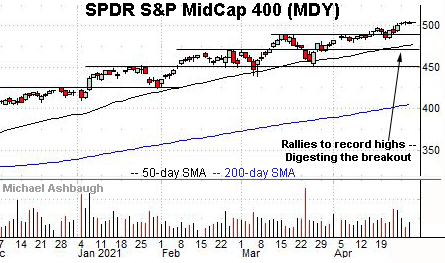

Meanwhile, the SPDR S&P MidCap 400 remains incrementally stronger.

Despite its recent flatlining posture, the MDY has managed to register a nominal record high across five straight sessions.

Placing a finer point on the S&P 500, the index has virtually flatlined week-to-date to punctuate otherwise bullish April price action.

Tactically, the prevailing range bottom (4,118) is followed by the S&P’s former projected target (4,085).

Delving deeper, the S&P’s 50-day moving average, currently 3,997, is closely followed by the early-April breakout point (3,983).

Tactically, a sustained posture atop this area signals a comfortably bullish intermediate-term bias.

Conversely, a near- to intermediate-term target projects to the 4,265 area on a break from the S&P’s prevailing range. Beyond specific levels, Friday’s close marks both a weekly and monthly close, and will likely add color.

Thursday’s Watch List

Drilling down further, consider the following sectors and individual names:

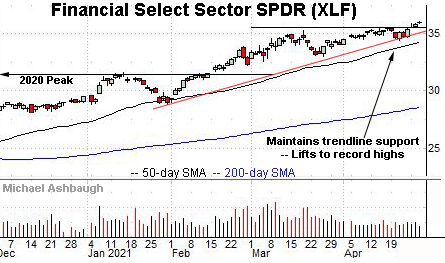

To start, the Financial Select Sector SPDR is acting well technically.

As illustrated, the group has rallied to record highs, rising in grinding-higher form after the Federal Reserve’s dovish policy statement, released Wednesday.

Tactically, the breakout point (35.50) is closely followed by trendline support roughly tracking the 50-day moving average, currently 34.28. The group’s uptrend is firmly-intact barring a violation.

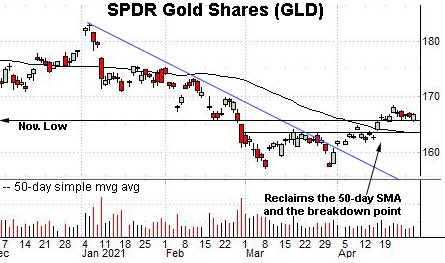

Meanwhile, the SPDR Gold Shares ETF has registered an April resurgence.

Technically, the shares are digesting a recent rally atop the breakdown point, circa 165.70.

Slightly more broadly, the early-April trendline breakout, the rally atop the 50-day moving average, and sustained break to two-month highs, are consistent with an intermediate-term trend shift.

Tactically, gold’s recovery attempt is intact barring a violation of the former range top (163.50) an area matching the 50-day moving average, currently 163.48.

Shopify, Inc. is a large-cap name coming to life.

As illustrated, the shares have staged a trendline breakout, knifing to nearly two-month highs after the company’s quarterly results.

The strong-volume spike punctuates a successful test of the 200-day moving average.

Tactically, the breakout point (1,250) is followed by trendline support currently matching the 50-day moving average. The prevailing rally attempt is intact barring a violation.

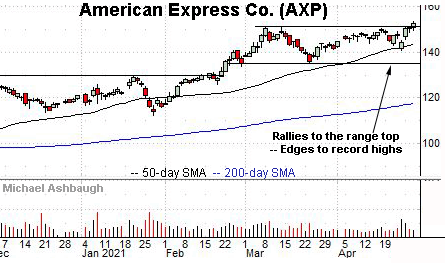

American Express Co. is a well positioned Dow 30 component.

Technically, the shares have rallied to record highs, clearing resistance matching the March peak.

The prevailing upturn punctuates a cup-and-handle — defined by the March and April lows — as well as a recent test of the 50-day moving average. A near-term target projects to the 160 area.

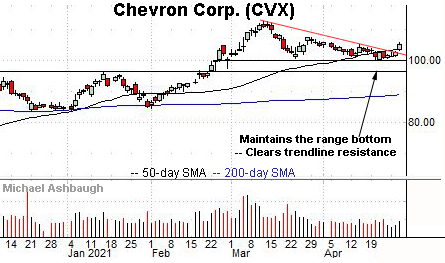

Finally, Chevron Corp. is a well positioned large-cap oil and gas name. (Yield = 5.0%.)

As illustrated, the shares have rallied atop trendline resistance. The prevailing upturn punctuates a tight mid-April range — a coiled spring — laying the groundwork for potentially more decisive follow-through.

Tactically, the trendline pivots to support, and is closely followed by the former range bottom (100.10). The prevailing rally attempt is intact barring a violation.

Note the company’s quarterly results are due out Friday.