Charting a massive summer breakout, S&P 500 tags 14-month highs

Focus: Small- and mid-caps extend trendline breakouts, Dow industrials rise from head-and-shoulders bottom

Broadly speaking, the major U.S. benchmarks continue to act well technically.

On a headline basis, the S&P 500 and Nasdaq Composite have taken flight, knifing to 14-month highs amid statistically unusual two standard deviation breakouts.

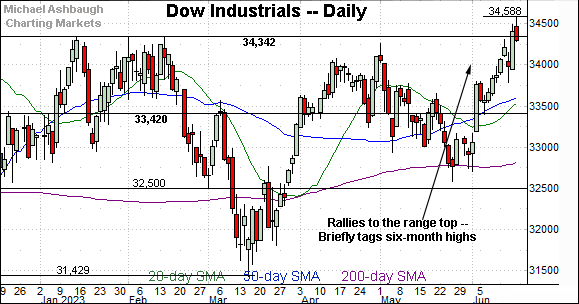

Meanwhile, the Dow Jones Industrial Average has tagged six-month highs, rising amid a backdrop that continues to set up well for potentially aggressive follow-through.

Editor’s Note: As always, updates can be directly accessed at https://chartingmarkets.substack.com.

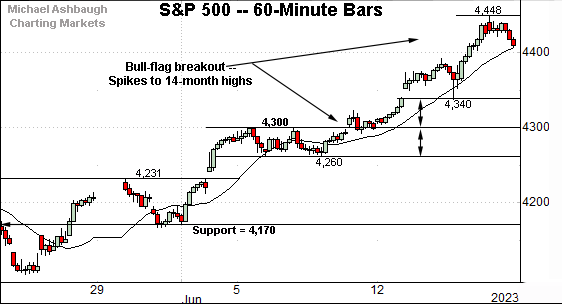

Before detailing the U.S. markets’ wider view, the S&P 500’s hourly chart highlights the past four weeks.

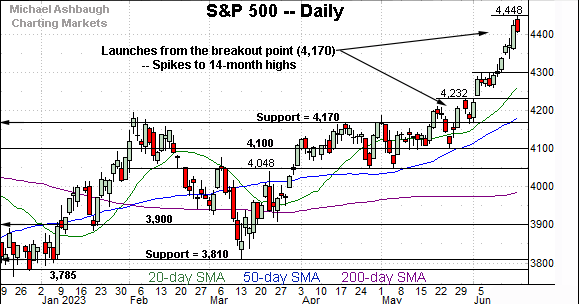

As illustrated, the S&P 500 has extended its June breakout, knifing to 14-month highs. Recent follow-through punctuates a bull flag, the formerly tight early-June range.

Slightly more broadly, the prevailing upturn originates from major support (4,170) an area also detailed on the daily and weekly charts. The June low (4,171) registered nearby.

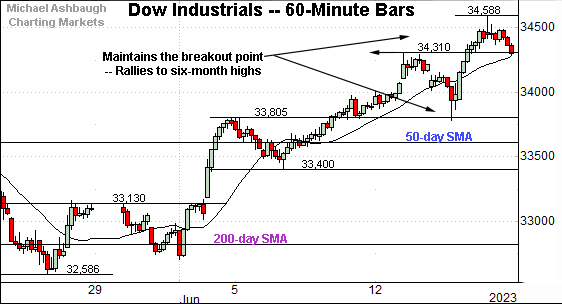

Meanwhile, the Dow Jones Industrial Average has tagged six-month highs.

Recent strength punctuates a successful test of the breakout point — the 33,800 area — and places the index back atop the 50-day moving average.

More broadly, the June upturn originates from the 200-day moving average, an area also detailed on the daily chart.

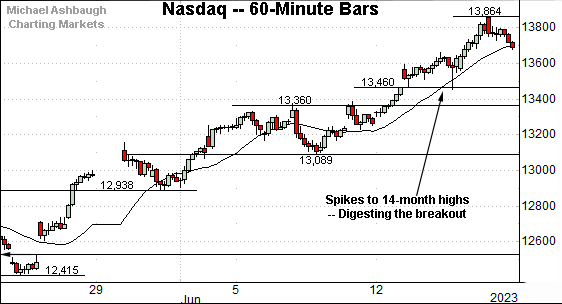

Against this backdrop, the Nasdaq Composite remains the strongest major benchmark.

As illustrated, the index has extended its June breakout, tagging 14-month highs amid bullish momentum better illustrated below.

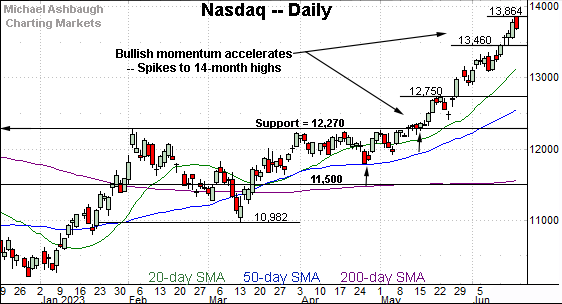

Widening the view to six months adds perspective.

On this wider view, the Nasdaq has staged a powerful five-week breakout.

The nearly straightline spike spans as much as 1,594 points, or 13.0%, atop the breakout point (12,270).

Though still near-term extended, and due a sideways chopping around phase, the aggressive five-week spike is longer-term bullish.

(On a granular note, the nearly straightline spike marks a two standard deviation breakout, encompassing three separate closes atop the 20-day volatility bands. The Nasdaq’s backdrop continues to signal statistically unusual bullish momentum.)

Looking elsewhere, the Dow Jones Industrial Average is rattling the cage on a breakout.

Recall the prevailing upturn originates from the 200-day moving average (in purple), a widely-tracked longer-term trending indicator.

More broadly, the June spike punctuates a head-and-shoulders bottom, defined by the December, March and June lows. As detailed previously, this is a high-reliability pattern, and lays the groundwork for potentially aggressive upside follow-through.

Meanwhile, the S&P 500 has taken flight.

Tactically, the straightline spike originates from the breakout point (4,170). The June low (4,171) matched support.

On a more detailed note, the June rally marks a statistically unusual two standard deviation breakout, encompassing consecutive closes atop the 20-day volatility bands, as well as three closes atop the bands across a 10-session window.

The potentially aggressive upside acceleration — detailed previously — has not only registered, it continues to follow-through.

The bigger picture

As detailed above, the major U.S. benchmarks are acting well technically.

On a headline basis, the S&P 500 and Nasdaq Composite have taken flight, knifing to 14-month highs amid statistically unusual two standard deviation breakouts.

Meanwhile, the Dow Jones Industrial Average has tagged six-month highs, rising amid a backdrop that continues to set up well for potential uspide follow-through. (See the daily chart.)

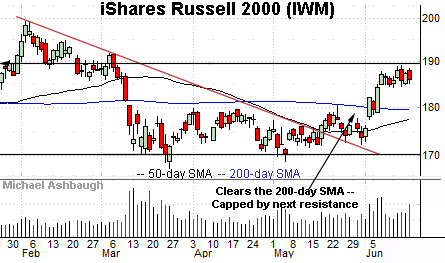

Moving to the small-caps, the iShares Russell 2000 ETF (IWM) has extended its June breakout.

The prevailing upturn punctuates an orderly 10-week range. Tactically, the breakout point closely matches the 200-day moving average, currently 179.60. This area pivots to support.

Conversely, the rally attempt has thus far been capped by next resistance (189.90) an area detailed previously. Also recall an intermediate-term target projected to the 190 area.

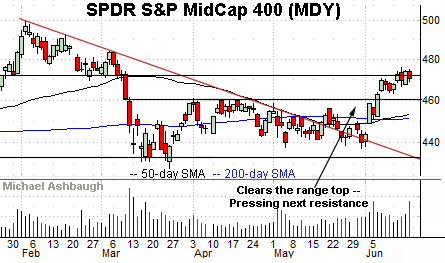

Similarly, the SPDR S&P MidCap 400 ETF (MDY) has staged a June breakout.

Here again, the prevailing upturn places it comfortably atop the 200-day moving average. Tactically, the breakout point (460.90) pivots to support.

Combined, the small- and mid-caps’ June price action signals the market rally continues to broaden.

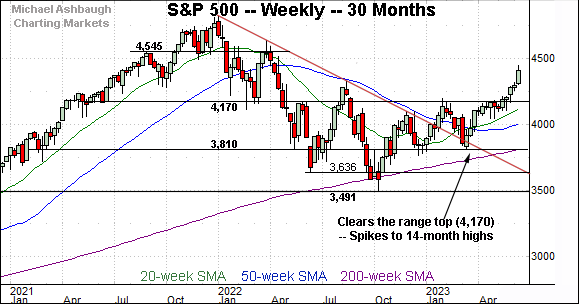

Returning to the S&P 500, this next chart is a weekly view spanning 30 months. Each bar on the chart represents one week.

As illustrated, the S&P has taken flight, placing distance atop major resistance (4,170) detailed repeatedly. (See the May 3, 2022 review — 13 months ago — and more recently, the May 23, 2023 review.)

Recall the June spike originates from the breakout point (4,170), an area also detailed on the daily chart.

On further strength, an upside target continues to project from the prior range to the 4,545 area. (Start with 4,170 - 3,810 = 360. Then, add the result back to the breakout point: 4,170 + 360 = 4,530.)

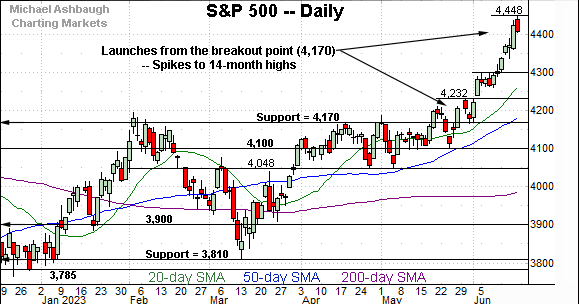

Narrowing to the S&P 500’s six-month view adds perspective.

As illustrated, the S&P has taken flight, extending a massive June breakout.

The nearly straightline spike spans as much as 277 points, or 6.6%, atop the breakout point (12,270).

Under normal market conditions, a breakout on the order of 1.0%+ would signal a valid break to a higher plateau.

So while this move has not been completely unexpected, the way the rally has registered is still striking. It’s also longer-term bullish.

But against this backdrop, the S&P 500 remains near-term extended and a consolidation phase is overdue. (See the April/May price action, hinged to the rally off the March low.)

Tactically, the 4,300 mark matches the S&P’s initial upside target (4,290) and this area pivots to first support.

Delving deeper, the S&P’s breakout point (4,170) marks a more important floor, currently matching the June low (4,171).

As always, it’s not just what the markets do, it’s how they do it. But broadly speaking, the S&P 500’s bigger-picture bias remains bullish barring a violation of the 4,170 area. (This area just launched a 6.6%, two standard deviation breakout, despite a seasonal headwind.)

Also see June 6: Bull trend broadens, S&P 500 knifes to nine-month highs.

Also see May 23: Bullish momentum accelerates, Nasdaq knifes to nine-month highs.