Charting a bull flag, S&P 500 and Dow industrials hesitate at major resistance

Focus: Rally attempt pauses near key levels as market bulls vie to extend gains

Technically speaking, the major U.S. benchmarks are off to a sideways June start, largely treading water amid decreased volatility.

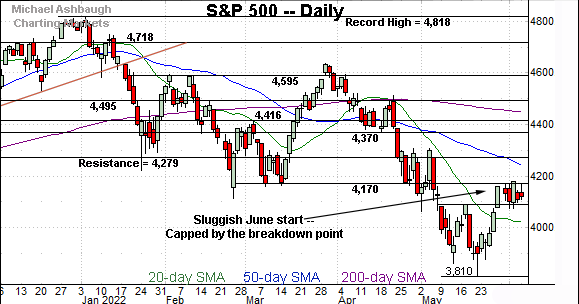

Against this backdrop, the S&P 500 and Dow industrials have thus far balked at major resistance — S&P 4,170 and Dow 33,240 — though the subsequent selling pressure has been muted amid a bull-bear stalemate.

Editor’s Note: As always, updates can be directly accessed at https://chartingmarkets.substack.com.

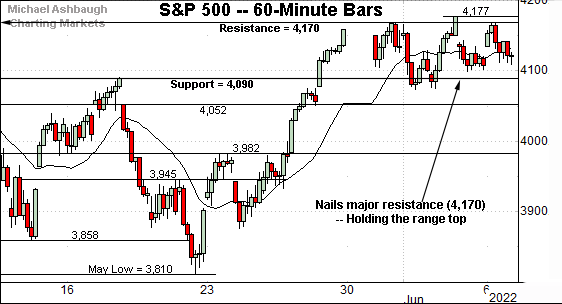

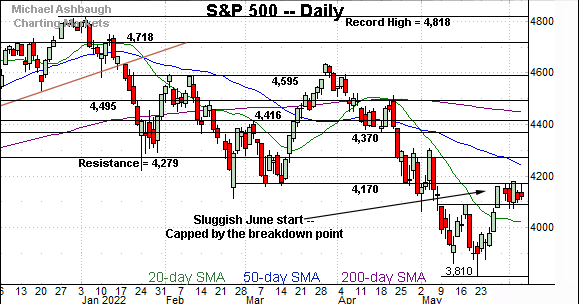

Before detailing the U.S. markets’ wider view, the S&P 500’s hourly chart highlights the past four weeks.

As illustrated, the S&P 500 has effectively nailed major resistance (4,170).

Monday’s session high (4,168.8) matched resistance, and the June peak (4,177) — established last week — also registered nearby.

More broadly, the tight June range — hinged to the steep late-May rally — punctuates a bull flag. This is a bullish near-term continuation pattern clashing with major resistance (4,170). The net result so far is a bull-bear stalemate.

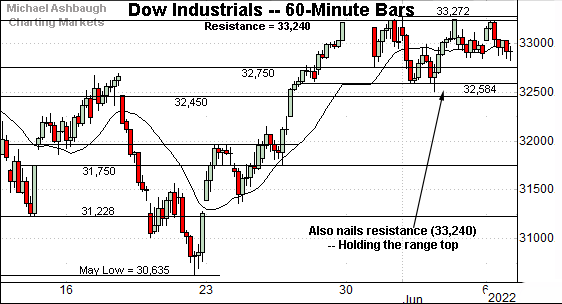

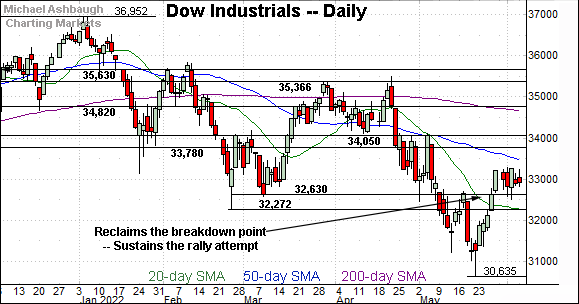

Similarly, the Dow Jones Industrial Average has tagged major resistance (33,240), an area detailed previously.

Monday’s session high (33,235) effectively matched resistance. (Recall the S&P 500 concurrently tagged the 4,170 resistance.)

And here again, the Dow’s relatively tight June range punctuates a bull flag hinged to the steep late-May rally.

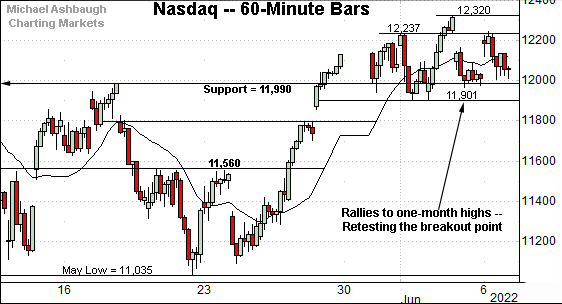

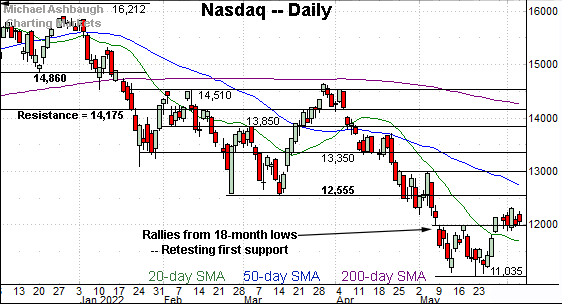

Against this backdrop, the Nasdaq Composite has also asserted a flag-like pattern at one-month highs.

Tactically, recall the breakout point — 11,990 area — pivots to support.

Delving slightly deeper, the early-June low (11,901) marks an inflection point.

Widening the view to six months adds perspective.

On this wider view, the Nasdaq has sustained a slight break from the mid-May range.

The tight June range punctuates a bull flag hinged to the steep rally off the May low. The sideways price action signals still muted selling pressure, laying the groundwork for potential upside follow-through.

(To be sure, the bull flag is a near-term pattern, and would be more reliable amid an uptrend rather than the prevailing primary downtrend. Nonetheless, trend shifts start somewhere, and the prevailing rally attempt is intact, based on today’s backdrop.)

Tactically, a sustained posture atop the 11,990 area preserves the prevailing rally attempt.

More broadly, the Nasdaq’s breakdown point (12,555) marks major resistance. The 50-day moving average, currently 12,688, is descending toward the breakdown point. Follow-through atop these areas would strengthen the intermediate-term bull case.

Looking elsewhere, the Dow Jones Industrial Average is digesting a more aggressive rally from the May low.

Tactically, the Dow’s former breakdown point — the 32,630 area — remains an inflection point, detailed repeatedly.

Tuesday’s early session low (32,641) has registered nearby. The prevailing near-term rally attempt is intact barring a violation of this area.

More broadly, eventual follow-through atop the 50-day moving average, currently 33,425, might strengthen the intermediate-term outlook.

Meanwhile, the S&P 500’s backdrop exemplifies the recent bull-bear tension.

Though the prevailing bull flag (the tight June range) is constructive, the pattern has been capped almost precisely by major resistance (4,170).

The bigger picture

As detailed above, the major U.S. benchmarks have virtually flatlined amid a bull-bear stalemate to start June. (At least “flatlined” in the context of an otherwise highly volatile 2022 backdrop.)

On a bullish note, each benchmark has thus far sustained its rally off the May low, and is vying to extend the near-term recovery attempt.

Still, the rally attempt has been capped by major resistance — at S&P 4,170 and Dow 33,240 — amid a firmly-bearish intermediate- to longer-term backdrop.

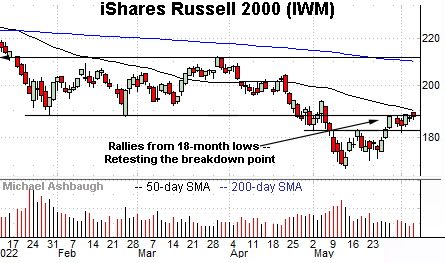

Moving to the small-caps, the iShares Russell 2000 ETF (IWM) continues to challenge its breakdown point — the 187.90-to-188.10 area, detailed previously.

Monday’s close (187.87) effectively matched resistance.

Conversely, initial support (182.60) is closely followed by the June low (181.77).

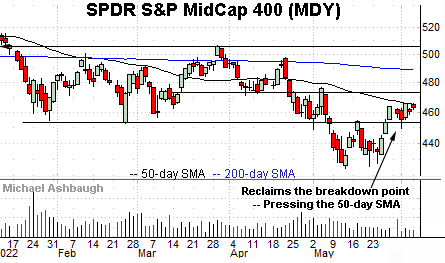

Meanwhile, the SPDR S&P MidCap 400 ETF (MDY) has sustained a rally atop its breakdown point (452.90), exhibiting relative strength versus the Russell 2000.

An extended test of the 50-day moving average, currently 464.48, remains underway.

Note the 50-day moving average has marked a year-to-date inflection point.

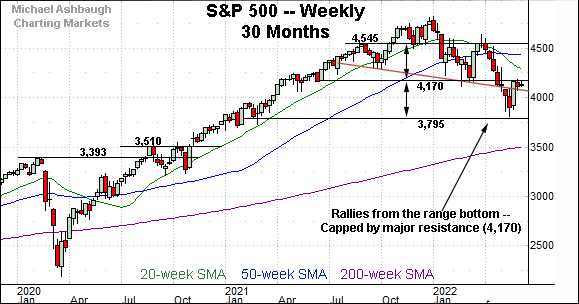

Returning to the S&P 500, this next chart is a weekly view, spanning 30 months. Each bar on the chart represents one week.

As illustrated, the index has asserted a lower plateau, capped by major resistance (4,170), detailed repeatedly.

To reiterate, Monday’s session high (4,168.8) matched resistance, marking the third straight weekly high to register nearby. As detailed repeatedly, follow-through atop the 4,170 area would mark technical progress.

Returning to the six-month view, the S&P 500 has sustained the bulk of its recent gains. Recall the initial rally spanned as much as 9.1%, across just six sessions, originating from the May low, near the 3,800 target.

Tactically, the prevailing recovery attempt is intact barring a closing violation of the former range top (4,090).

Conversely, upside follow-through atop major resistance (4,170) likely opens the path to a higher plateau. Note the 50-day moving average, currently 4,233, is descending within view.

Beyond near-term issues, the S&P’s bigger-picture trends remain bearish, based on today’s backdrop. No new setups today.

Also see May 31: Market bulls resurface, S&P 500 approaches headline technical test (4,170).