Bull trend confirmed, Dow industrials within striking distance of 40,000 mark

Focus: Major U.S. benchmarks tag record highs as Q1 close approaches

Technically speaking, the major U.S. benchmarks continue to trend higher, rising as the first-quarter conclusion (end of March) approaches.

On a headline basis, the S&P 500 and Dow industrials have concurrently tagged all-time highs, knifing from previously tight March ranges. Meanwhile, the Nasdaq Composite has registered a record closing high, amid a breakout attempt that technically remains underway. The charts below add color:

Editor’s Note: As always, updates can be directly accessed at https://chartingmarkets.substack.com.

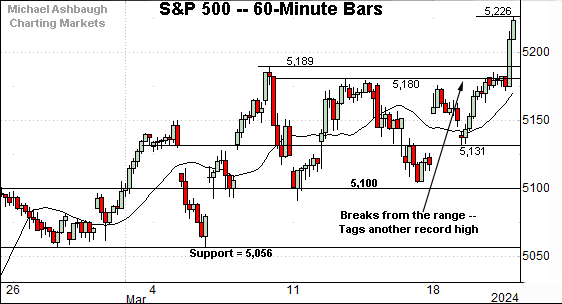

Before detailing the U.S. markets’ wider view, the S&P 500’s hourly chart highlights the past four weeks.

As illustrated, the S&P 500 has knifed to its latest all-time high.

The breakout puntuates a tight mid-March range, spanning about 90 points, or less than 2.0%. Tactically, the breakout point — the 5,180 area — pivots to support.

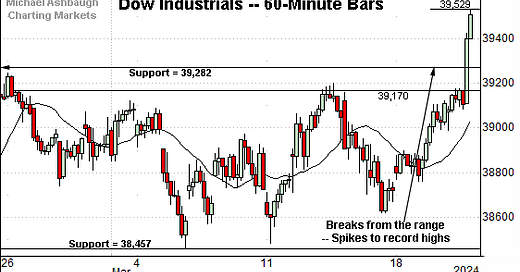

Similarly, the Dow Jones Industrial Average has knifed to record territory.

The prevailing upturn punctuates a one-month range, also illustrated on the daily chart. Tactically, the 39,280 and and 39,170 areas pivot to support.

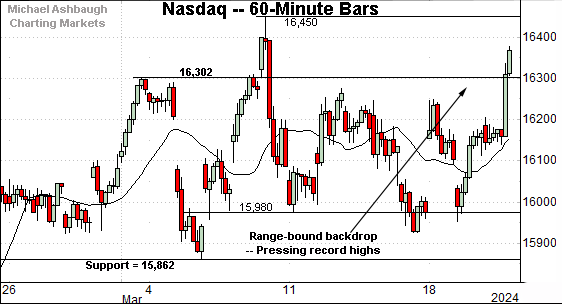

Against this backdrop, the Nasdaq Composite has also staged a breakout of sorts.

Here again, the prevailing upturn punctuates a relatively tight mid-March range. Tactically, the 16,300 area marks an inflection point.

Combined, each big three benchmark has staged a late-March spike, rising amid well received Federal Reserve policy language.

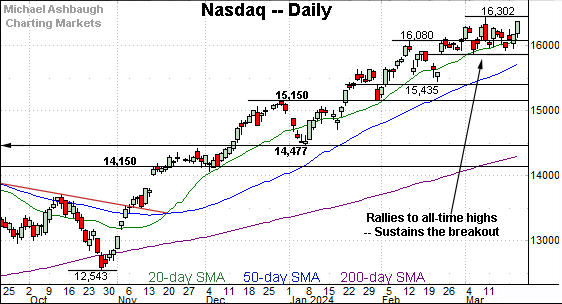

Widening the view to six months adds perspective.

On this wider view, the Nasdaq has registered an all-time closing high.

Slightly more broadly, the prevailing four-week range is a bullish continuation pattern, hinged to the sharp late-February gap higher. Tactically, the 15,860 area marks notable support. (Also see the hourly chart.)

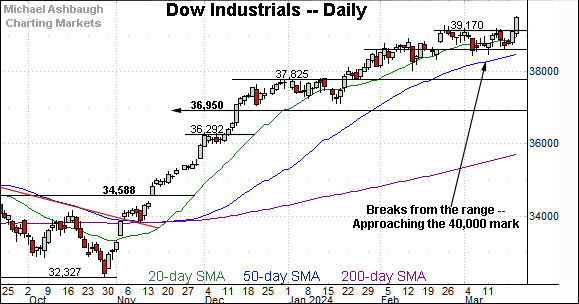

Looking elsewhere, the Dow Jones Industrial Average has broken more decisively to all-time highs.

The prevailing upturn punctuates a tight four-week range — a coiled spring — likely confirming the primary uptrend. (The single-day spike registered as a nearly 1.0% breakout.)

More broadly, the marquee 40,000 mark is firmly within striking distance.

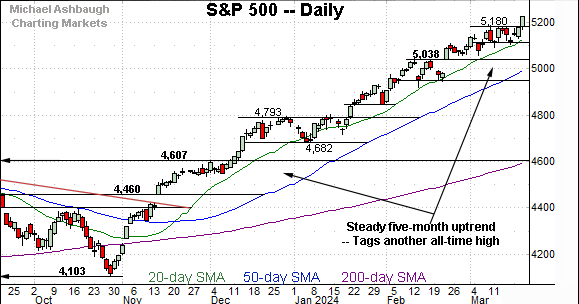

Meanwhile, the S&P 500 has also tagged its latest record high.

Recent follow-through punctuates an unusually steady five-month uptrend. The prevailing trend has tracked atop the 20-day moving average (in green) a widely-tracked near-term trending indicator.

The bigger picture

As detailed above, the prevailing bigger-picture uptrend is largely on auto-pilot. At least for now.

On a headline basis, each big three benchmark has concurrently registered an all-time closing high. Bullish momentum is intact as the first-quarter conclusion approaches. (The end of March.)

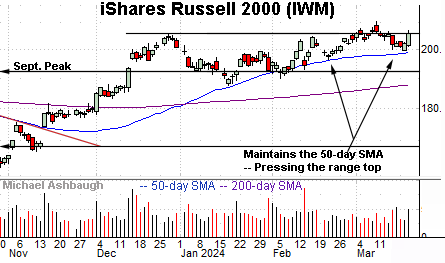

Moving to the small-caps, the iShares Russell 2000 ETF (IWM) continues to lag behind.

Nonetheless, the small-cap benchmark continues to hold its range top after briefly tagging 23-month highs.

Tactically, the 50-day moving average has marked an inflection point going back before November trendline breakout.

Meanwhile, the SPDR S&P MidCap 400 ETF (MDY) continues to outpace the small-caps.

As illustrated, the MDY has asserted a tight March range, digesting an early-month rally to all-time highs.

The prevailing flag-like pattern — the tight range — lays the groundwork for potential upside follow-through.

Returning to the S&P 500, the index continues to grind higher.

The mid-January breakout placed the S&P at all-time highs — atop the 2022 peak (4,818) — and the index has since trended steadily higher.

The early-year uptrend tracks atop the 20-day moving average (in green) a widely-tracked near-term trending indicator.

Tactically, the breakout point (5,180) is followed by the March range bottom, circa 5,050.

Delving deeper, the 50-day moving average, currently 5,000, is rising toward gap support (5,038).

As always, it’s not just what the markets do, it’s how they do it. But broadly speaking, the S&P 500’s bigger-picture bias remains bullish barring a violation of the 5,000-to-5,040 area.

Also see Feb. 22: Bull trend intact, S&P 500 absorbs mid-month downdraft.