Charting a bull-flag breakout attempt, S&P 500 extends to record highs

Focus: U.S. benchmarks concurrently register record closes ahead of earnings season

U.S. stocks are higher early Monday, rising ahead of second-quarter earnings season, set to kick off this week.

Against this backdrop, each big three U.S. benchmark concurrently registered a record close to conclude last week, and is vying Monday to extend its uptrend.

Editor’s Note: As always, updates can be directly accessed at chartingmarkets.substack.com.

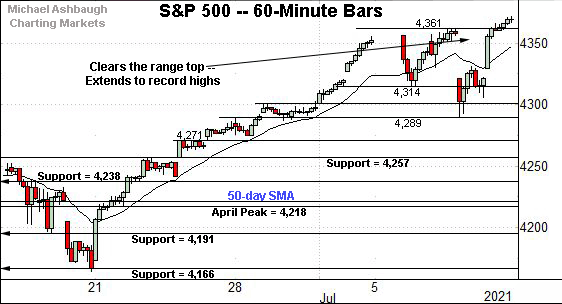

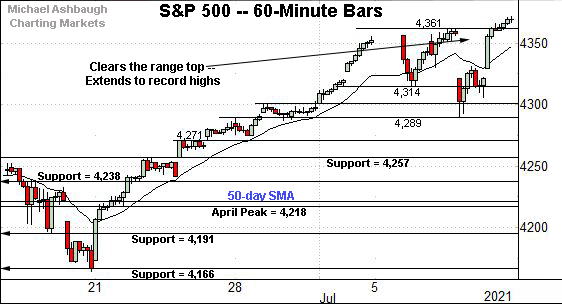

Before detailing the U.S. markets’ wider view, the S&P 500’s hourly chart highlights the past four weeks.

As illustrated, the S&P has cleared its range top, tagging another record high.

The prevailing upturn punctuates a successful test of near-term support (4,314) on a closing basis.

From current levels, the former range top (4,361) pivots to support.

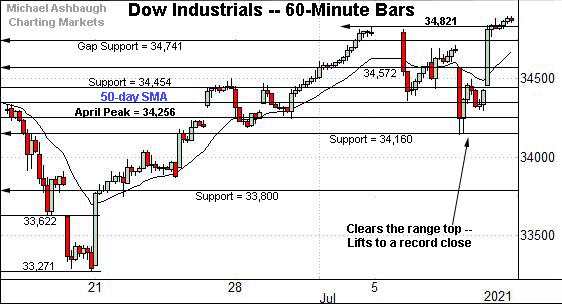

Meanwhile, the Dow Jones Industrial Average has rallied to register a record close.

The Dow’s absolute record peak (35,091.56) — established May 10 — remains slightly more distant, as detailed on the daily chart.

Conversely, the prevailing upturn originates from support matching the former range bottom (34,160).

Last week’s low (34,145) registered nearby.

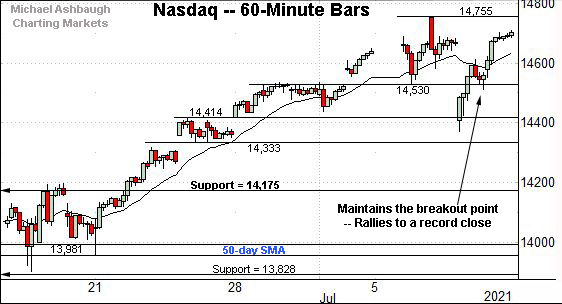

Against this backdrop, the Nasdaq Composite is digesting an early-month break to record territory.

Its prevailing range has been underpinned by near-term support (14,530) on a closing basis.

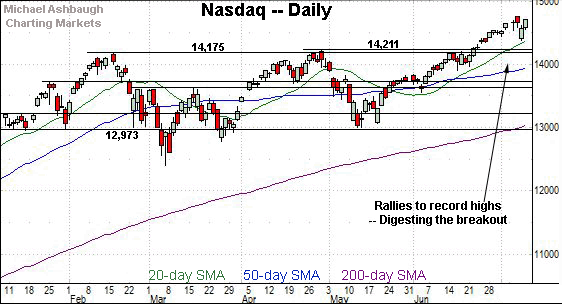

Widening the view to six months adds perspective.

On this wider view, the Nasdaq is digesting a decisive break to record territory.

Tactically, the 20-day moving average, currently 14,394, is followed by major support in the 14,175-to-14,211 area.

More broadly, the prevailing breakout confirms the Nasdaq’s primary uptrend.

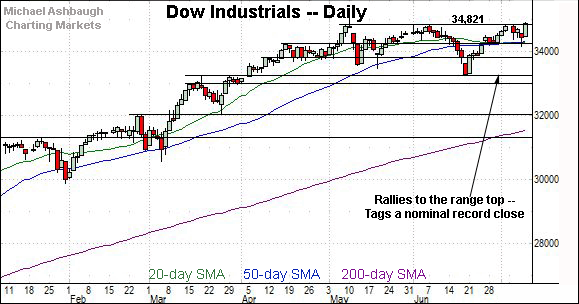

Looking elsewhere, the Dow Jones Industrial Average has tagged a record close, edging atop notable resistance (34,821) detailed previously.

The prevailing upturn places the Dow’s absolute record peak (35,091.56) within striking distance.

More broadly, the slight breakout punctuates a double bottom — the W formation — defined by the May and June lows.

An intermediate-term target projects to the 36,350 area.

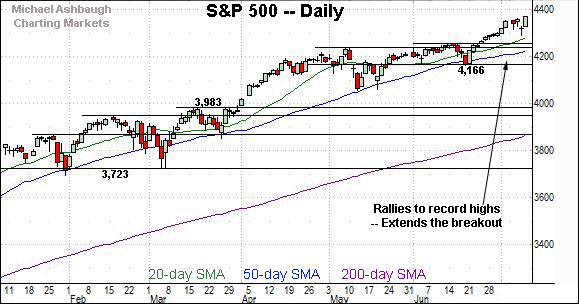

Meanwhile, the S&P 500 has slightly extended its rally to record territory.

The prevailing flag-like pattern punctuates the S&P’s two standard deviation breakout — encompassing consecutive closes atop the 20-day Bollinger bands — across July’s first two sessions. Bullish price action.

The bigger picture

As detailed above, the U.S. benchmarks’ bigger-picture backdrop remains comfortably bullish.

On a headline basis, each big three U.S. benchmark concurrently registered a record close to conclude last week, and is vying to extend its uptrend with the latest earnings season set to start this week.

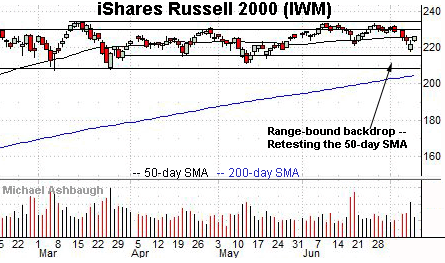

Moving to the small-caps, the iShares Russell 2000 ETF remains range-bound.

Recall the 50-day’s flattish slope signals an absence of trend, consistent with a range-bound backdrop.

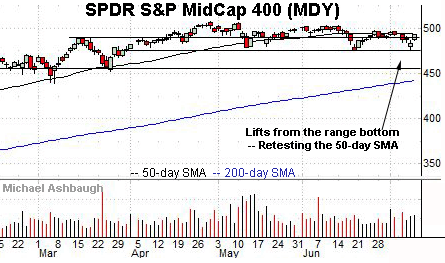

Similarly, the SPDR S&P MidCap 400 ETF has effectively flatlined since March.

Its latest retest of the 50-day moving average, currently 493.48, remains underway.

Placing a finer point on the S&P 500, the index has extended to its latest record high.

Tactically, the former range top (4,361) is followed by near-term support (4,314), an area roughly matching the S&P’s former projected target (4,310).

Returning to the six-month view, the S&P 500 has slightly extended its July breakout.

The prevailing upturn punctuates a flag pattern — hinged to the early-July breakout — a move encompassing consecutive closes atop the 20-day Bollinger bands.

As always, consecutive closes atop the bands signal a near-term extended posture — due a cooling-off phase — amid a bullish longer-term outlook.

Put differently, the S&P’s July price action fits the description of a valid breakout. See the initial late-June spike, subsequent sideways July price action, and modest upside follow-through.

Also recall that the prevailing flag pattern has been underpinned by first support (4,314) on a closing basis. Constructive price action.

On further strength, a near-term target projects from the July flag pattern to the 4,430 area.

No new setups today. Back in action Wednesday.