Charting bullish follow-through: Nasdaq nails the breakdown point (14,896)

Focus: Financials tag all-time highs, Amazon reclaims 50- and 200-day averages, XLF, AMZN, FCX, TRIP, MRK

U.S. stocks are mixed early Monday, vacillating ahead of a full slate of quarterly earnings reports, due out this week.

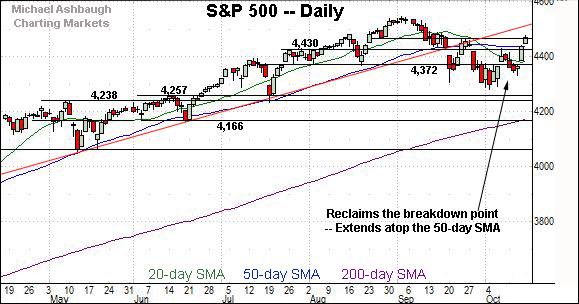

Against this backdrop, the S&P 500 has extended its technical breakout, though slightly, placing distance atop its 50-day moving average.

Meanwhile, the Nasdaq Composite is vying to reclaim its breakdown point (14,896), a key bull-bear fulcrum, detailed repeatedly. Last week’s close (14,897) matched inflection point.

Editor’s Note: As always, updates can be directly accessed at chartingmarkets.substack.com.

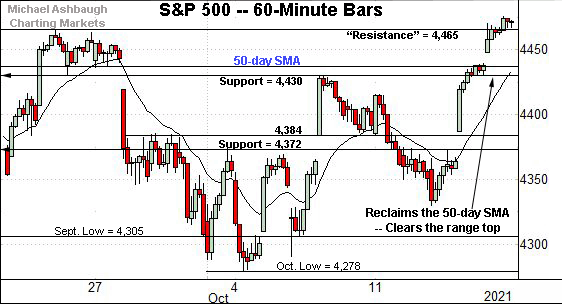

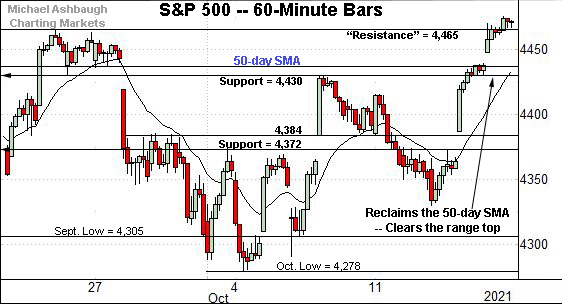

Before detailing the U.S. markets’ wider view, the S&P 500’s hourly chart highlights the past four weeks.

As illustrated, the S&P has extended its rally attempt, reclaiming the 50-day moving average, currently 4,438.

Moreover, the index has cleared its range top, tagging a nominal one-month high. Last week’s close (4,471) registered slightly above resistance.

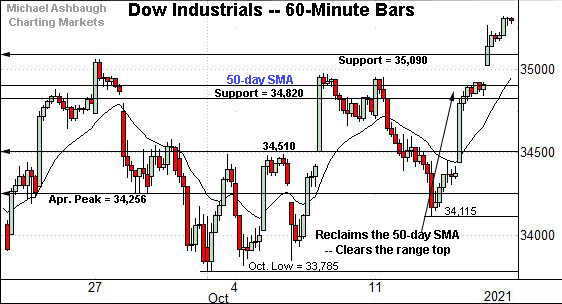

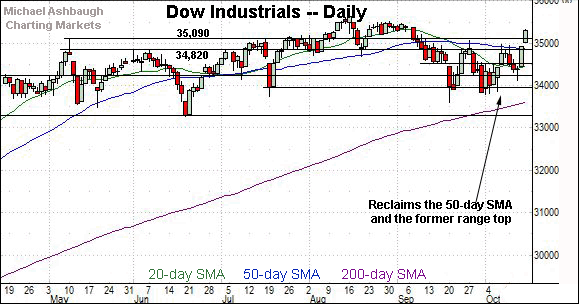

Similarly, the Dow Jones Industrial Average has tagged one-month highs.

The prevailing upturn places it back atop the 50-day moving average, currently 34,881, and former resistance matching the May peak (35,091).

Both areas area also detailed on the daily chart.

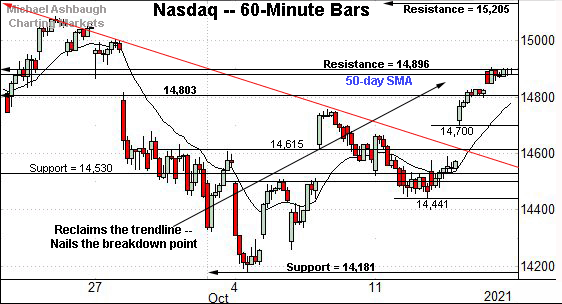

True to recent form, the Nasdaq Composite remains the weakest major benchmark.

Nonetheless, the index is challenging two key technical levels. Namely:

The 50-day moving average, currently 14,870.

The breakdown point (14,896) an area also illustrated below.

Last week’s close (14,897) matched the breakdown point, a familiar bull-bear fulcrum, detailed repeatedly. An extended retest remains underway.

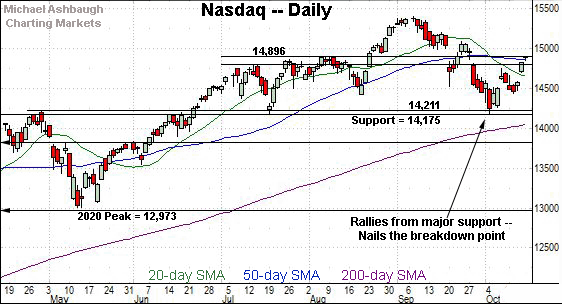

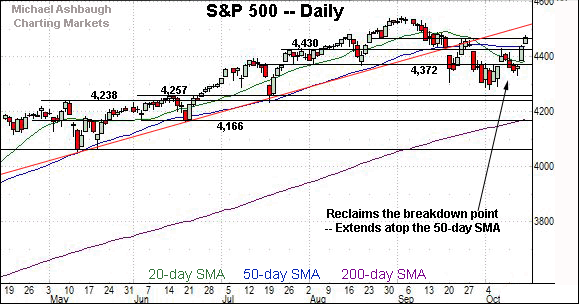

Widening the view to six months adds perspective.

On this wider view, the Nasdaq is challenging its breakdown point, an area broadly spanning from 14,803 to 14,896.

This area marks an intermediate-term bull-bear fulcrum, detailed repeatedly. (See, for instance, each review last week.)

Against this backdrop, last week’s close (14,897) matched resistance, and an extended retest remains underway. Sustained follow-through atop this area would signal a bullish-leaning intermediate-term bias.

Looking elsewhere, the Dow Jones Industrial Average has broken out.

In the process, the index has reclaimed its 50-day moving average and resistance matching the May peak (35,091).

Tactically, the Dow’s backdrop supports a bullish intermediate-term bias barring a swift reversal back under the 34,820 area.

More broadly, the prevailing upturn punctuates a mini double bottom defined by the September and October lows.

Similarly, the S&P 500 has come to life technically.

The prevailing upturn places the index atop its former breakdown point (4,430) and the 50-day moving average, currently 4,438.

The bigger picture

As detailed above, the U.S. benchmarks’ bigger-picture backdrop continues to strengthen.

On a headline basis, the S&P 500 and Dow industrials have extended breaks atop major resistance, areas roughly matching the 50-day moving average — the S&P 4,430 and Dow 34,820 areas.

Tactically, each benchmark’s backdrop supports a bullish-leaning intermediate-term bias barring a swift reversal back under these areas.

Meanwhile, the Nasdaq Composite has nailed its breakdown point (14,896), an intermediate-term bull-bear fulcrum, detailed repeatedly.

Last week’s close (14,897) matched the breakdown point, and the Nasdaq has ventured atop resistance early Monday. Sustained follow-through higher would signal a bullish-leaning intermediate-term bias.

Moving to the small-caps, the iShares Russell 2000 ETF remains range-bound.

Tactically, the prevailing upturn places a three-month range top (229.84) within view. The pending retest from underneath may add color.

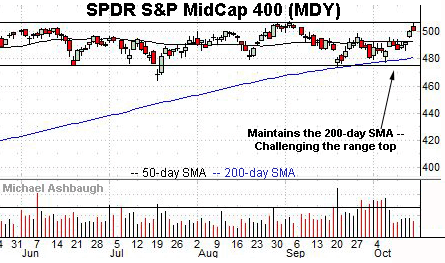

Meanwhile, the SPDR S&P MidCap 400 ETF has rallied within view of all-time highs.

The MDY’s record close (506.04) and absolute record peak (507.63) are firmly within striking distance.

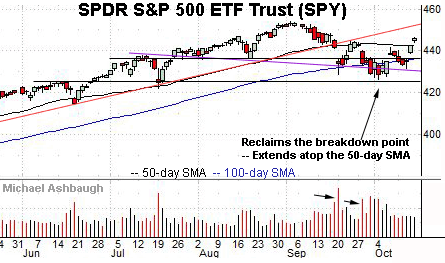

Looking elsewhere, the SPDR Trust S&P 500 ETF has extended its bullish reversal.

In the process, the SPY has reclaimed its 50-day moving average, currently 442.76.

Perhaps as notably, last week’s (445.87) close registered atop the late-September peak (444.89) likely neutralizing a developing head-and-shoulders top.

The prevailing upturn originates from the pattern’s neckline (in purple).

Placing a finer point on the S&P 500, the index has notched consecutive closes atop its 50-day moving average, currently 4,438.

Tactically, gap support (4,439) effectively matches the 50-day moving average.

More broadly, the S&P 500 has registered a “higher high” versus the late-September peak (4,465).

Last week’s close (4,471) registered slightly atop resistance, and the S&P 500 seems to have sustained its gains early Monday.

Combined, the S&P’s reversal atop three technical levels — the 4,430 mark, the 50-day moving average, and the late-September peak (4,465) — signals a bullish-leaning intermediate-term bias, to the extent these areas are subsequently maintained.

Against this backdrop, the best six months seasonally — November through April — are two weeks away. The markets’ response to this week’s full slate of quarterly earnings reports will likely add color.

Watch List

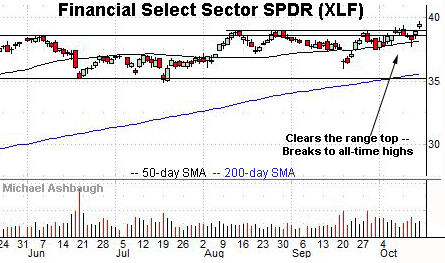

Drilling down further, the Financial Select Sector SPDR has broken out, tagging all-time highs.

The prevailing upturn punctuates a head-and-shoulders bottom defined by the mid-August, September and October lows.

Tactically, the breakout point (39.40) is followed by the ascending 50-day moving average, currently 38.18.

Conversely, a near-term target continues to project to the 40.30 area.

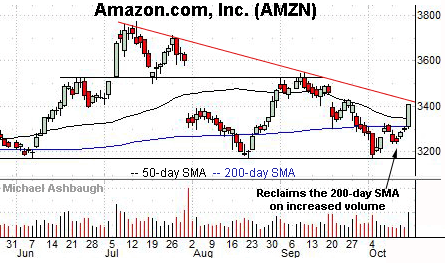

Moving to specific names, Amazon.com, Inc. — profiled Oct. 8 — has come to life technically.

In the process, the shares have knifed atop the 50- and 200-day moving averages — across just one session — rising amid a volume spike.

On further strength, trendline resistance is followed by the late-September peak (3,429). Follow-through atop this area would mark a “higher high” raising the flag to a potential trend shift.

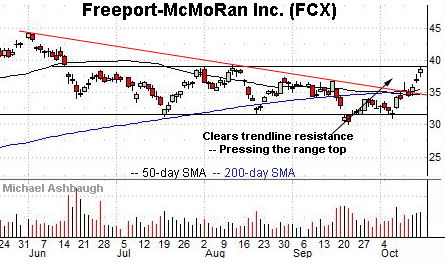

Freeport-McMoRan Inc. is a large-cap miner of copper, gold and related minerals.

Technically, the shares have recently knifed atop trendline resistance closely matching the 50- and 200-day moving averages.

The prevailing upturn places a four-month range top (39.20) under siege. Follow-through atop this area would punctuate a double bottom defined by the July and September lows.

Tactically, a breakout attempt is in play barring a violation of near-term support, circa 36.80.

Note the company’s quarterly results are due out Oct. 21.

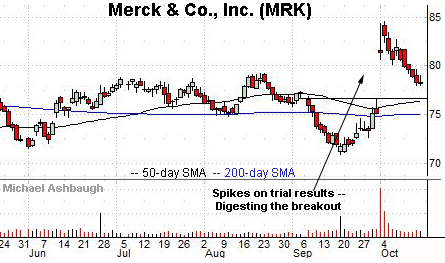

Merck & Co., Inc. is a well positioned large-cap pharmaceutical name. (Yield = 3.3%.)

Earlier this month, the shares knifed to 20-month highs, rising after the company reported positive trial results for its COVID-19 treatment.

The subsequent pullback has been fueled by decreased volume, placing the shares 8.0% under the October peak.

Tactically, gap support (76.65) is closely followed by the 50-day moving average, currently 76.44. A sustained posture atop this area signals a bullish bias.

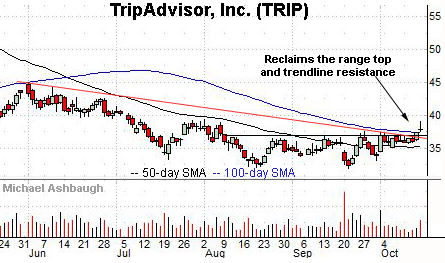

Finally, TripAdvisor, Inc. is a large-cap name showing signs of life.

As illustrated, the shares have tagged two-month highs, clearing trendline resistance on increased volume.

Tactically, the breakout point, circa 37.00, is closely followed by trendline support. The prevailing rally attempt is intact barring a violation.